Central banks have been buying a squillion tonnes of gold, promise

Central banks have been buying a squillion tonnes of gold, promise中央银行已经购买了数千万吨黄金,保证

Are the numbers real?

© REUTERS

Unlock the Editor’s Digest for free

免费解锁编辑摘要

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

《金融时报》的编辑 Roula Khalaf 在本周的通讯中挑选了她最喜欢的故事。

Gold continues to soar because of reasons. One of the most cited reasons of late has been all the central bank buying. Per the ECB in June:

黄金持续飙升的原因有很多。最近被引用最多的原因之一是各国央行的购金行为。根据欧洲央行在六月的报告:

The demand for gold by central banks remained at record highs in 2024, accounting for more than 20% of global demand, in contrast to around one-tenth on average in the 2010s.

2024 年,中央银行对黄金的需求保持在创纪录的高位,占全球需求的 20%以上,而在 2010 年代,平均仅占十分之一。

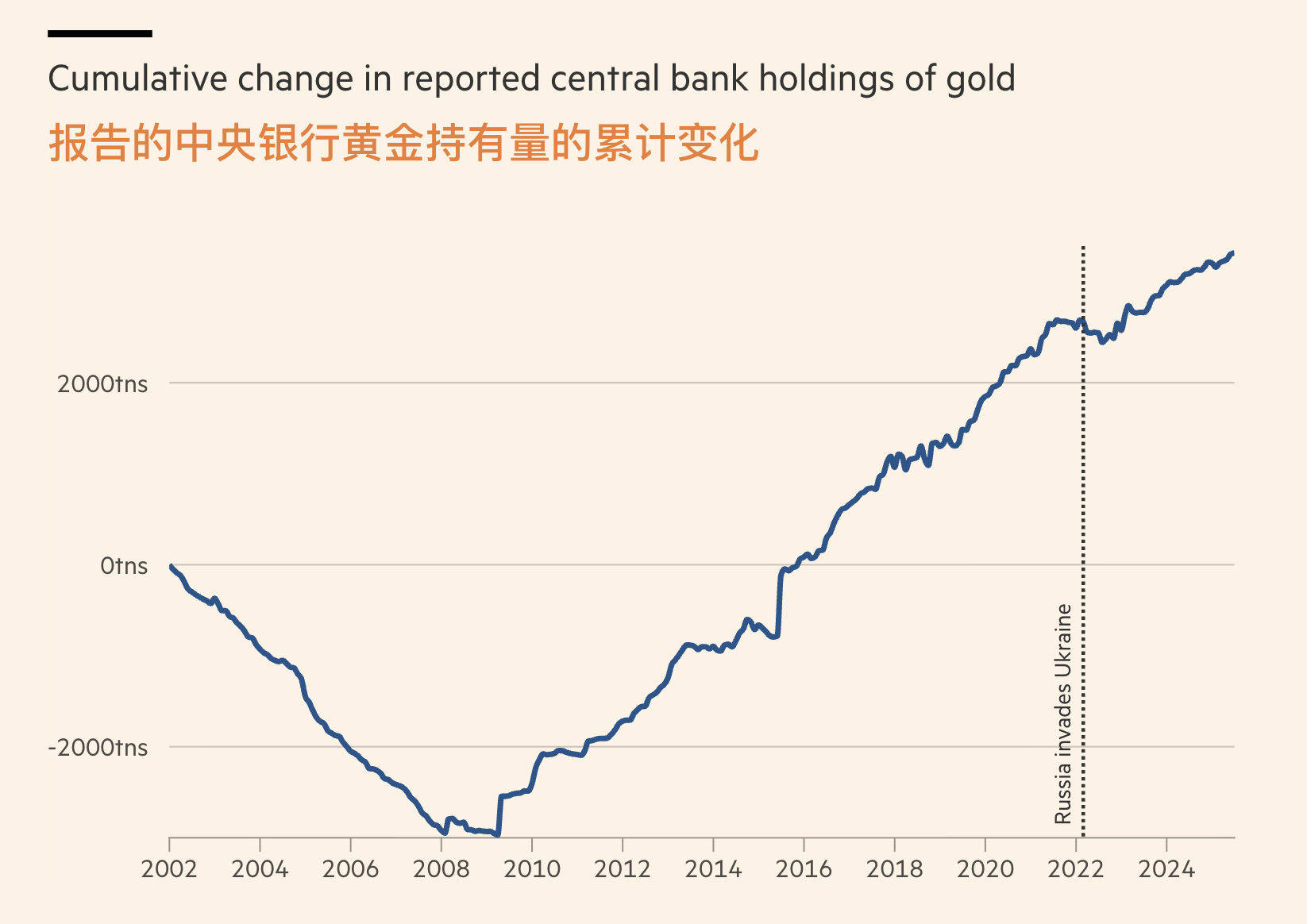

But how do we know? You’d think that maybe central bank buying would show up in increases in central bank holdings of gold. And it does, sort of. But the data doesn’t correspond to the headlines.

但我们怎么知道呢?你可能会认为,中央银行的购买应该会体现在中央银行黄金持有量的增加上。确实是这样,某种程度上。但数据与头条新闻并不相符。

Central banks’ reported gold holdings have increased by 228 tonnes over the most recent twelve months reported. Is this a lot? It’s the weight of about forty African bush elephants, so objectively yes. But 228 tonnes is actually not that much in central bank purchase terms.

Central banks’ reported gold holdings have increased by 228 tonnes over the most recent twelve months reported. Is this a lot? It’s the weight of about forty African bush elephants, so objectively yes. But 228 tonnes is actually not that much in central bank purchase terms.

中央银行报告的黄金持有量在最近报告的十二个月中增加了 228 吨。这算多吗?这相当于大约四十头非洲草原大象的重量,所以客观上来说是的。但 228 吨在中央银行的购买量中实际上并不算多。

In fact, 228 tonnes puts the twelve months to June 2025 in the bottom quartile of gold purchases over the past five years, 10 years and 15 years.

事实上,228 吨使得截至 2025 年 6 月的十二个月在过去五年、十年和十五年的黄金购买中处于底部四分之一。

So why is everyone is talking about unprecedented levels of central bank buying?

那么,为什么大家都在谈论前所未有的中央银行购买水平呢?

It turns out that these reports rely on estimates of ‘unreported’ official gold demand. Add these in and total central bank purchases jump to a whopping 804 tonnes.

事实证明,这些报告依赖于对“未报告”官方黄金需求的估计。如果将这些计算在内,中央银行的总购买量跃升至惊人的 804 吨。

And 804 tonnes — as well as being about seven-and-a-half times as heavy as a blue whale — puts the total purchases into the top tercile of the past five and 10 years, and top quartile of the past 15 years.

而 804 吨——不仅约为蓝鲸重量的七倍半——使得总购买量进入过去五年和十年的前三分之一,以及过去十五年的前四分之一。

What even are ‘unreported’ gold purchases? To understand this, we first need to understand the official numbers.

What even are ‘unreported’ gold purchases? To understand this, we first need to understand the official numbers.

“未报告”的黄金购买到底是什么?要理解这一点,我们首先需要了解官方数字。

Official central bank gold holding numbers come from the IMF. But reporting to the IMF is purely voluntary. According to the ECB, the “Central Bank of Russia stopped reporting its gold purchases one month before the sanctions were imposed, although it is expected to have been a large purchaser in 2022.” And so the ECB, like the rest of us, turn to the World Gold Council for estimates of ‘unreported’ purchases.

官方中央银行黄金持有数据来自国际货币基金组织(IMF)。但向 IMF 报告是完全自愿的。根据欧洲中央银行(ECB)的说法,“俄罗斯中央银行在制裁实施前一个月停止报告其黄金购买,尽管预计在 2022 年它会是一个大买家。”因此,ECB 和我们其他人一样,转向世界黄金协会以获取“未报告”购买的估计。

As a reminder, the WGC is the gold mining trade body dedicated to pumping up the gold price serving the gold market and its participants / making weird videos about Elton John’s kneecaps.

作为提醒,WGC 是一个致力于提升黄金价格的黄金矿业行业机构,服务于黄金市场及其参与者/制作关于埃尔顿·约翰膝盖的奇怪视频。

The WGC report total central bank purchases that are far higher than the official numbers. But perhaps conscious of their cheerleading reputation, they have since 2014 outsourced estimates on the demand side to Metals Focus, an independent precious metals consultancy.

WGC 报告显示,中央银行的购买总量远高于官方数字。但也许是出于对自己助威声誉的考虑,自 2014 年以来,他们将需求方面的估计外包给了独立的贵金属咨询公司 Metals Focus。

Estimating unreported central bank purchases is hard. In fact, this is not actually something they even do — though they do estimate net purchases by central banks and other official sector institutions like sovereign wealth funds.

估计未报告的中央银行购买量是困难的。事实上,这实际上并不是他们所做的事情——尽管他们确实会估算中央银行和其他官方部门机构(如主权财富基金)的净购买量。

But with SWF assets under management eclipsing $13tn — around the same size as total central bank reserves — it’s possible that central banks’ gold reserves are pretty much what they report to the IMF, and that gold purchases are built up entirely outside central banks. Maybe we’re splitting hairs.

但随着主权财富基金管理的资产超过 13 万亿美元——大约与中央银行的总储备相当——中央银行的黄金储备可能基本上就是它们向国际货币基金组织报告的数字,而黄金购买完全是在中央银行之外积累的。也许我们是在斤斤计较。

Furthermore, as the WGC writes in its methodology document:

此外,正如 WGC 在其方法论文件中所写:

Given the opacity and complexity of the market, supply and demand statistics are best thought of as estimates, with some estimates being more accurate than others.

鉴于市场的复杂性和不透明性,供需统计数据最好被视为估算,其中一些估算比其他的更为准确。

Most important statistics, like GDP and the CPI, are estimates. But the process by which they are estimated and aggregated is a matter of public record and subject to scrutiny.

最重要的统计数据,如 GDP 和 CPI,都是估算值。但它们的估算和汇总过程是公开记录,并受到审查的。

Alphaville doesn’t doubt the level of professionalism and expertise going into Metals Focus numbers. But it’s not possible to interrogate non-public information gathered together from off-the-record conversations with miners, refiners, bullion dealers, etc, about gold flows. And estimates will vary depending on who is doing the estimating.

Alphaville 对 Metals Focus 数据的专业性和专业知识没有怀疑。但无法对从与矿工、精炼商、金条交易商等的非公开对话中收集到的信息进行质询,关于黄金流动的情况。而且,估计的结果会因估算者的不同而有所差异。

Back in 1999, and all the way through 2010, the WGC sourced its data from GFMS Thomson Reuters. When it switched data provider to Metals Focus, in order to avoid big jumps in published estimates of demand, they published a hybrid series and smoothed the transition over four years — slowly de-emphasising the GFMS Thomson Reuters data and increasing the weight of Metals Focus data.

早在 1999 年,一直到 2010 年,世界黄金协会(WGC)从 GFMS 汤森路透获取数据。当它更换数据提供商为 Metals Focus 时,为了避免发布的需求估计出现大幅波动,他们发布了一个混合系列,并在四年内平滑过渡——逐渐降低 GFMS 汤森路透数据的权重,同时增加 Metals Focus 数据的权重。

We can understand their desire not to spook the market with janky data spikes, but the need to do this highlights quite how much art must go into them.

我们可以理解他们不想用不可靠的数据波动来惊扰市场的愿望,但这样做的必要性突显了其中需要投入多少艺术。

All that said, putting the gold rally at the door of central bank buying is massively intuitive. Following Russia’s invasion of Ukraine their central bank was sanctioned and its reserves frozen. European leaders are still chatting about whether they can be seized within the current legal architecture. And so it doesn’t take a genius to see that even a shiny pet rock looks a safer bet than electronic IOUs controlled by your enemies/ frenemies.

话虽如此,将黄金的上涨归因于中央银行的购买是非常直观的。在俄罗斯入侵乌克兰后,他们的中央银行遭到制裁,储备被冻结。欧洲领导人仍在讨论在当前法律框架下是否可以没收这些资产。因此,聪明人都能看出,即使是一块闪亮的宠物石也比由你的敌人/朋友控制的电子债务凭证更安全。

And it’s in this context that the relationship between the yield on US inflation-linked government bonds — the TIPS yield — and the yellow metal has collapsed:

在这种背景下,美国与通胀挂钩的政府债券收益率——TIPS 收益率——与黄金之间的关系已经崩溃:

So we’re not going to rain on the goldbugs’ parade. In fact, given how tinfoil hat goldbugs can get, maybe it’s fitting that at least part of the narrative about the rally is based on statistics that seek to describe opaque backroom chatter rather than official data.

So we’re not going to rain on the goldbugs’ parade. In fact, given how tinfoil hat goldbugs can get, maybe it’s fitting that at least part of the narrative about the rally is based on statistics that seek to describe opaque backroom chatter rather than official data.

所以我们不会破坏金虫们的兴致。事实上,考虑到那些戴着铝箔帽的金虫们可能会变得多么激动,也许部分关于这次反弹的叙述基于试图描述不透明的幕后闲聊而非官方数据,这正是合适的。