ai rating summary

🧠 Analysis Trace

🏷️ 金融市场 (Market) | 信息密度:9 | 🆕 新颖度:8 判断: 文章深刻剖析了中美关系在金融市场中的演变,打破了中国“不可投资”的旧论,并警示美国未来政策选择的潜在风险,观点独到且具启发性。

🎯 核心信号 (The Signal)

- 一句话:自2024年初以来,中美市场“多美空中”的投资逻辑已失效,中国通过七年“卧薪尝胆”已具备对抗美国制裁的能力,美国正面临选择:要么效仿中国推行工业政策但恐难成功,要么改善对华关系,这预示着全球市场的主导趋势将再次摆动。

- 关键要点或时间证据链条线:

- 2018-2024年,因美国半导体禁运,中国被视为“不可投资”,美国则“例外”,导致“做多美国/做空中国”成为主导投资策略。

- 自2024年初,中国市场表现开始逆转,短期做空中国不再奏效,美国市场也失去绝对领先优势。

- 中国在过去七年间通过“去西方化”供应链和集中资源发展,已增强对美国制裁的韧性,尤其在AI(如DeepSeek、Qwen模型)等领域取得突破。

- 美国在同一时期未能“去中国化”供应链,反而赤字激增,目前面临选择:效仿中国推行产业政策(但其成功率存疑且面临高昂社会成本,如腐败、资本浪费、股市承压)或改善对华关系。

- 美国近期政策转向(特朗普政府与习主席会晤增多,国家安全战略将中国从“生存威胁”降级为“战略竞争者”)预示着双边关系可能改善,这将对全球投资格局产生深远影响。

⚖️ 立场与倾向 (Stance & Bias)

- 作者意图:深度探讨 / 劝诱

- 潜在偏见:倾向于认为美国效仿中国推行工业政策将难以成功且成本高昂;对中国应对制裁的能力和策略持肯定态度;对美国长期依赖金融市场表现来维持经济增长持谨慎态度。

🌲 关键实体与作用 (Entities & Roles)

- Gavekal Research : 作者所属机构,提供宏观经济与市场研究服务。 ⇒ [中立]

- 美国 (US) : 2018年半导体禁运的发起者,长期以来市场表现“例外”,当前面临政策选择,其工业政策成功性受到质疑,可能导致股市挣扎和美元走软。 ⇒ [中立/负面]

- 中国 (China) : 2018年半导体禁运的受害者,七年来推行“去西方化”供应链政策,牺牲短期增长以增强韧性,并在AI等领域取得突破,其市场正变得“可投资”。 ⇒ [中立/正面]

- Donald Trump : 2025年回归执政的美国总统,其政策曾导致广泛关税战,但近期表现出改善中美关系的意愿,并承认G2世界格局。 ⇒ [中立]

- Scott Bessent : 美国财政部长,提到特朗普和习主席可能会面多次,暗示双边关系改善的可能性。 ⇒ [中立]

- Rand Corporation : 美国智库,曾发布报告建议美国与中国建立建设性关系,并质疑保卫台湾的国家利益,但报告很快被撤回,反映了美国内部对华态度的分歧。 ⇒ [中立]

- DeepSeek/Qwen : 中国AI模型,在文章中作为中国技术实力和突破美国制裁的证据,标志着中国在技术顶峰的竞争力,并“化解”了美国制裁的部分影响。 ⇒ [正面]

💡 启发性思考 (Heuristic Questions)

- 如果美国选择不效仿中国推行工业政策,也未能成功改善与中国的关系,那么除了文章提出的两种路径,美国还有哪些可行的策略来应对其供应链脆弱性和保持全球竞争力?

original content

US Exceptionalism Versus Chinese Uninvestibility (Part I)美国的优越性与中国的不可投资性(第一部分)

Gavekal Research | 9 Dec 2025

Policy Choices

The thesis of my two most recent books (available on the Gavekal website; great Christmas gift for your loved ones!) was that the 2018 US semiconductor embargo against China changed the world. The age of cooperation and globalization was over. Instead, the semi-embargo marked the start of the Clash of Empires. In the years that followed, China became “uninvestible” and the US became “exceptional.” This bifurcation in destinies was the most important investment trend of the period from 2018 to 2024. Anyone long the US and short China thrived. This was really the only trade to have on.

我最近两本书的核心论点(可在 Gavekal 网站上获取;送给亲人的绝佳圣诞礼物!)是:2018 年美国对华半导体出口禁令改变了世界。合作与全球化的时代已经结束。取而代之的是,半禁运标志着帝国冲突时代的开启。在随后的几年中,中国变得“不可投资”,而美国则成为“例外”。这种命运的分野,是 2018 年至 2024 年间最重要的投资趋势。任何做多美国、做空中国的投资者都获得了巨大收益。这实际上就是唯一值得做的交易。

However, since early 2024, the short-China leg of this trade has clearly stopped working. Meanwhile, the long-US leg is also no longer outperforming everything in sight. So has the world changed again? I believe it has, and will try to explain the reasons for this belief in a series of upcoming papers. This paper is the first of this series, and is dedicated to US policy choices, how these have affected relative returns, and where they go from here.

然而,自 2024 年初以来,做空中国的这一部分交易显然已不再奏效。与此同时,做多美国的部分也再无法持续跑赢所有资产。那么,世界是否再次发生了变化?我认为确实如此,并将在接下来的一系列论文中尝试解释这一信念的原因。本文是该系列的第一篇,重点探讨美国的政策选择、这些选择如何影响相对回报,以及未来可能走向何方。

1) Rope-a-dope

With the 2018 embargo, the US essentially punched China on the nose. At the time, China had little choice but to take the punch. Take the punch and prepare its own economy for a future in which it would be less vulnerable to further US embargoes. In Avoiding the Punch, I used a line from Walter Spanghero, the famous French rugby captain of the 1970s, to explain what was happening. Coming off a bruising encounter against France’s favorite enemy, Spanghero was asked about the punch on the nose he had received from his English opposite number. Spanghero, who has a proper French nose—big enough that he can easily smoke in the shower—replied “it’s a good thing my nose was there, otherwise he would have hit me right in the face.”

2018 年的制裁,美国实际上是在向中国挥出一拳。当时,中国别无选择,只能硬接这一拳,并为未来做好准备——在这样一个未来中,中国经济将不再那么容易受到美国进一步制裁的影响。在《避开这一拳》一文中,我引用了上世纪 70 年代著名的法国橄榄球运动员沃尔特·斯潘格罗的一句话来解释当时的情况。在经历了一场与法国宿敌英格兰队的激烈对抗后,斯潘格罗被问及自己鼻梁上那记来自对方对手的重击。斯潘格罗有着典型的法国人高挺的鼻子——大到足以在洗澡时轻松叼着烟抽——他回答道:“幸好我的鼻子在那里,否则他那一拳就直接打到我脸上去了。”

In this analogy, equity and real estate markets were China’s nose. The economy was its face. And for China, saving the economy’s long term prospects meant rapidly de-Westernizing its supply chains. After all, if the US could ban semiconductors today, the US might choose to ban chemical products, auto parts, or nuclear fuel rods tomorrow. Concretely, this meant capturing the massive pool of Chinese savings and redirecting the money away from everything but the single goal of de-Westernizing supply chains. This was massively deflationary for China, and for the world.

在这个类比中,股市和房地产市场是中国的鼻子。经济则是它的脸。对于中国而言,拯救经济的长期前景意味着迅速实现供应链的去西方化。毕竟,如果美国今天能禁止半导体,明天就可能选择禁运化学品、汽车零部件或核燃料棒。具体来说,这意味着要掌控中国庞大的储蓄池,并将资金从所有其他用途转向唯一目标——实现供应链的去西方化。这对中国经济乃至全球都具有巨大的通缩效应。

Essentially, for seven long years China went on a diet, and went to the CrossFit gym. And as all of China’s savings were captured—through tighter capital controls, the suspension of IPOs, and the concentration of bank lending—and redirected towards China’s industrial supply chains, returns for investors were dreadful. The capital markets serving the world’s second largest economy became “uninvestible.”

本质上,在长达七年的时光里,中国一直在节食,还去参加了 CrossFit 健身训练。随着中国所有的储蓄都被集中控制——通过更严格的资本管制、IPO 暂停以及银行贷款向国内工业供应链的集中——投资者的回报惨淡至极。服务于世界第二大经济体的资本市场变得“无法投资”。

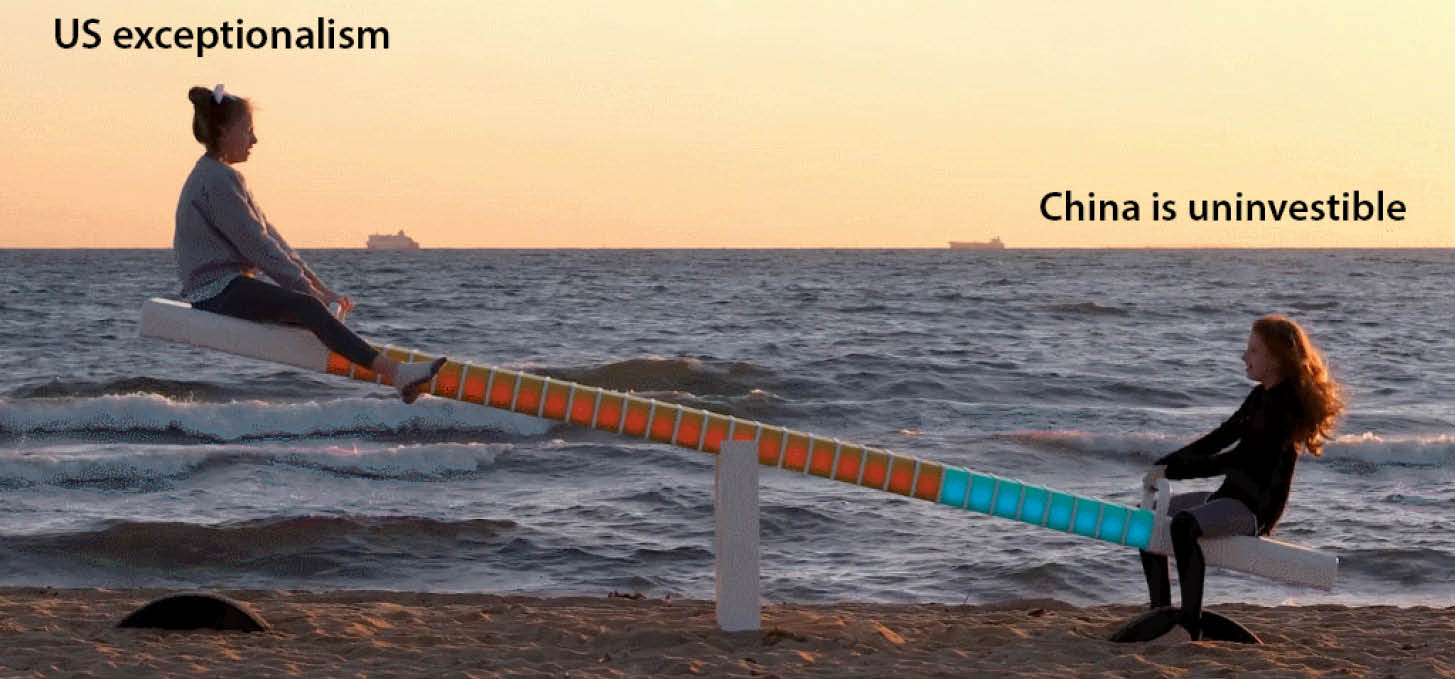

And the fact that the world’s second largest economy was uninvestible made the largest all that much more “exceptional.” In the land of the blind, the one-eyed man is king. Or as we have illustrated in our slide decks over recent years, with China going down on the see-saw, the US rose.

正是由于世界第二大经济体变得无法投资,使得最大的经济体显得更加“非凡”。在盲人国度里,独眼之人便是国王。正如我们近年来在演示文稿中所展示的那样,随着中国如跷跷板般下滑,美国则随之上升。

This is why the recent Geneva, Kuala Lumpur and Seoul meetings between US and Chinese officials were so important (see A Rapidly Changing World). These meetings highlighted that while in 2018, China had no choice but to take the punch, the past seven years of going to the gym have paid off. China no longer needs to pump iron (and follow massively deflationary policies).

这正是近期美国与中国官员在日内瓦、吉隆坡和首尔举行会谈如此重要的原因(参见《迅速变化的世界》)。这些会谈表明,尽管 2018 年时中国别无选择只能承受打击,但过去七年持续的努力已见成效。如今,中国不再需要强行举重(也无需再奉行大规模紧缩政策)。

When Donald Trump came back to power in 2025, he was clearly angry. So angry that this time around, Trump did not confine his punches just to China. Europe got a shiner. Mexico, India, Brazil and Vietnam all got gut-punched. Even Canada—unused to getting hit—got a taste of blood in its mouth. US foreign policy suddenly looked like a bar scene in which the six foot six inch big drunk guy was throwing punches around at anyone who might get close. This is when China, which had spent the past seven years getting toned, showed up and essentially said: “Gloves off. If you want a fight, let’s go. You tariff me, then I will tariff you. You embargo me, then I will embargo you. Meet me outside.”

当唐纳德·特朗普于 2025 年再度掌权时,他显然怒不可遏。愤怒到这一次,特朗普的攻击不仅限于中国,欧洲也遭到了重击,墨西哥、印度、巴西和越南全都受到了猛烈打击,就连一向不常被针对的加拿大,也尝到了口中的血腥味。美国的外交政策突然看起来就像一场酒吧斗殴——一个六英尺六英寸高的大个子醉汉在人群中四处挥拳,谁靠近就打谁。就在这个时刻,过去七年一直保持实力的中国站了出来,几乎直接宣告:“摘掉手套吧。你要打架,那就来。你对我加征关税,我就对你加征关税;你对我实施禁运,我就对你实施禁运。咱们外面见。”

And the US backed down (see What Next For US-China Relations?). The US backed down because without Chinese rare earths, the US weapons industry would essentially shut down. Or at the very least, it would struggle to help allies such as Israel or Ukraine stay replenished at a time of war.

而美国最终退缩了(参见《美中关系的下一步走向?》)。美国之所以退缩,是因为若没有中国的稀土资源,美国的武器工业将基本陷入瘫痪,至少在战时也无法有效支持以色列或乌克兰等盟友维持补给。

But even without focusing on weapons, can any sitting US president afford to have American auto plants shut down because of his foreign policy?

但即使不考虑军工领域,任何在任的美国总统又能否承受得起因外交政策导致美国汽车工厂全面停产的后果?

In short, seven years ago, the US launched a supply-chain war against China. China’s response was to de-Westernize its supply chain, at great cost to its investor base, to economic growth, to domestic consumption and even to its birth rate (see The Catch-22 Of Asian Growth and Around The World Of Policy Goals).

简而言之,七年前,美国对中国发起了供应链战争。中国的回应是,不惜代价地推进供应链去西方化,这给其投资者群体、经济增长、国内消费乃至出生率都带来了严重影响(参见《亚洲增长的悖论》及《全球政策目标纵横谈》)。

Meanwhile, over the same period, the US did absolutely nothing to de-Sinify its own supply chain. While China hit the gym, the US partied. And partied hard: US budget deficits expanded, but pretty much just funded expansions in social benefits—social security, Medicare and Medicaid. Between 2018 and 2025, US government debt increased from US38.4trn. However, none of the US$17trn or so increase in debt went into building new Hoover dams, new Tennessee Valley Authorities, new interstate highways or new railroads.

与此同时,在同一时期,美国并未采取任何措施来减少其供应链对中国的依赖。当中国在努力提升自身实力时,美国却在尽情享乐,而且是大肆享乐:美国的预算赤字不断扩张,但几乎全部用于扩大社会福利——社会保障、医疗保险和医疗补助。从 2018 年到 2025 年,美国政府债务从 21 万亿美元增至 38.4 万亿美元。然而,这大约 17 万亿美元的债务增长,并未用于建设新的胡佛大坝、新的田纳西河谷管理局项目、新的州际公路或新的铁路系统。

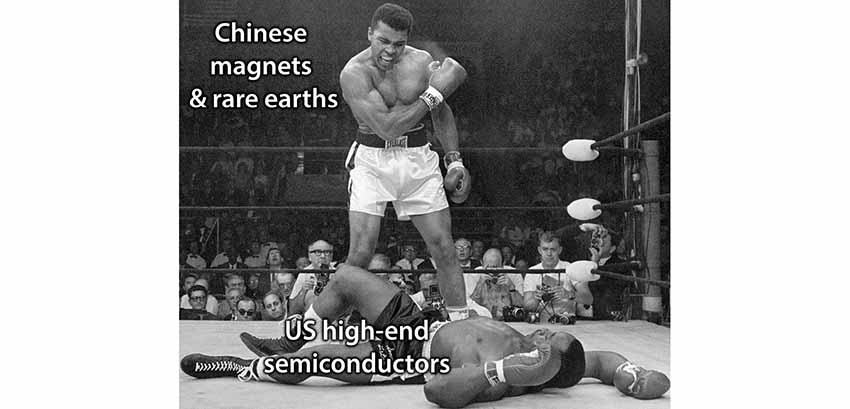

As a result, to stay with the fisticuffs analogy, seven years into the trade/tech war it increasingly looks like China played “rope-a-dope.” Like Muhammad Ali in the Rumble in the Jungle, China took the punches from her much bigger, much stronger opponent. This gave China’s opponent a false sense of security. A false sense of security which was reinforced by the very impressive relative performance of US equities against China (and everyone else) and by the strength of the US dollar.

因此,用拳击比喻来说,七年过去,这场贸易战和技术战越来越像是中国采取了“缠抱战术”。就像穆罕默德·阿里在“丛林之战”中所做的那样,中国承受了来自体型更大、实力更强对手的重重打击。这使对手产生了一种虚假的安全感。这种错觉又因美国股市相对于中国(以及全球其他市场)极为出色的相对表现,以及美元的强势而进一步强化。

However, away from the limelight, Chinese government bond returns crushed all others. This should have been a sign that perhaps the Chinese economy was not imploding after all; when an emerging market hits the economic skids, bonds and the currency tend to collapse rather than strengthen. But in spite of our best efforts to draw people’s attention to Chinese bonds, no one cared; and this even though the amount of capital deployed in bond markets typically dwarfs the amount of money invested in stocks.

然而,在聚光灯之外,中国国债回报率碾压了所有其他资产。这本应是一个信号,表明中国经济或许并未如人们所担心的那样崩溃;当新兴市场陷入经济困境时,债券和货币通常会暴跌而非走强。但尽管我们竭尽全力提醒人们关注中国债券,却无人问津;而这甚至令人惊讶,因为投入债券市场的资金规模通常远超股市投资。

The Chinese government bond market and the renminbi were signaling that growth in China was slowing, but that the economy was not imploding. Instead, like Muhammad Ali, the Chinese leadership was just waiting for the right time to strike. And that time essentially came with the release of DeepSeek’s AI models (see Another Sputnik Moment). DeepSeek and then Qwen showed the Chinese leadership, and the world, that China could be competitive at the very pinnacle of technology, in artificial intelligence, in spite of the US embargo. To a large extent, DeepSeek defanged US sanctions. This, in turn, allowed China to fight back.

中国国债市场与人民币发出的信号表明,中国经济正在放缓,但并未陷入崩溃。相反,如同穆罕默德·阿里一般,中国领导人只是在等待合适的时机出手。而这一时机基本上随着 DeepSeek 人工智能模型的发布到来(参见《另一个斯普特尼克时刻》)。DeepSeek 随后的 Qwen 模型向中国领导层乃至全世界证明,即便面临美国的封锁,中国仍能在人工智能这一科技最前沿领域具备竞争力。在很大程度上,DeepSeek 削弱了美国制裁的效力,进而使中国得以反击。

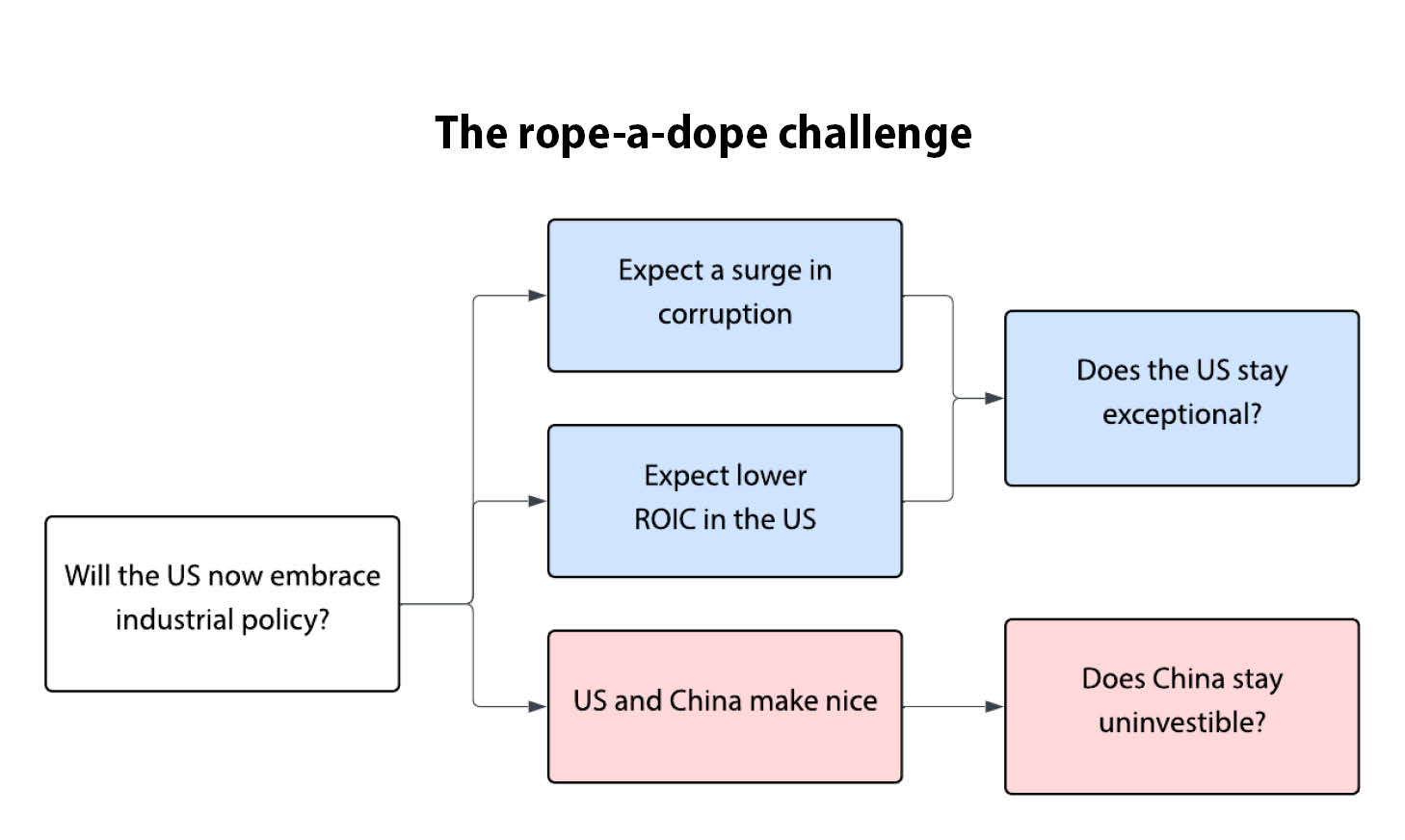

And so, after partying for the past seven years, the US now faces a choice. One path is to follow the trail blazed by China and embrace industrial policy in an attempt to de-Sinify its supply chains. This would mean redirecting capital from areas of high returns such as tech and into shipping (see Soon We’ll Be Shipbuilding), rare earths (see The Rare Earths Tussle Continues and Rare Earth Dominance), aluminum etc. As in China, this would likely mean much greater government interference in the way companies are run (remember the Chinese tech crackdown?). A development the market is unlikely to cheer.

因此,在过去七年狂欢之后,美国如今面临一个选择。一条路径是效仿中国,推行产业政策,试图将其供应链去“中国化”。这意味着将资本从科技等高回报领域重新配置到造船(参见《我们很快将开始造船》)、稀土(参见《稀土之争持续不断》和《稀土主导地位》)、铝等领域。如同中国一样,这很可能意味着政府对企业发展方式的干预程度大幅提高(还记得中国的科技行业整顿吗?)。这一发展恐怕难以获得市场的欢迎。

The other option is to make nice with China.

另一个选择是与中国搞好关系。

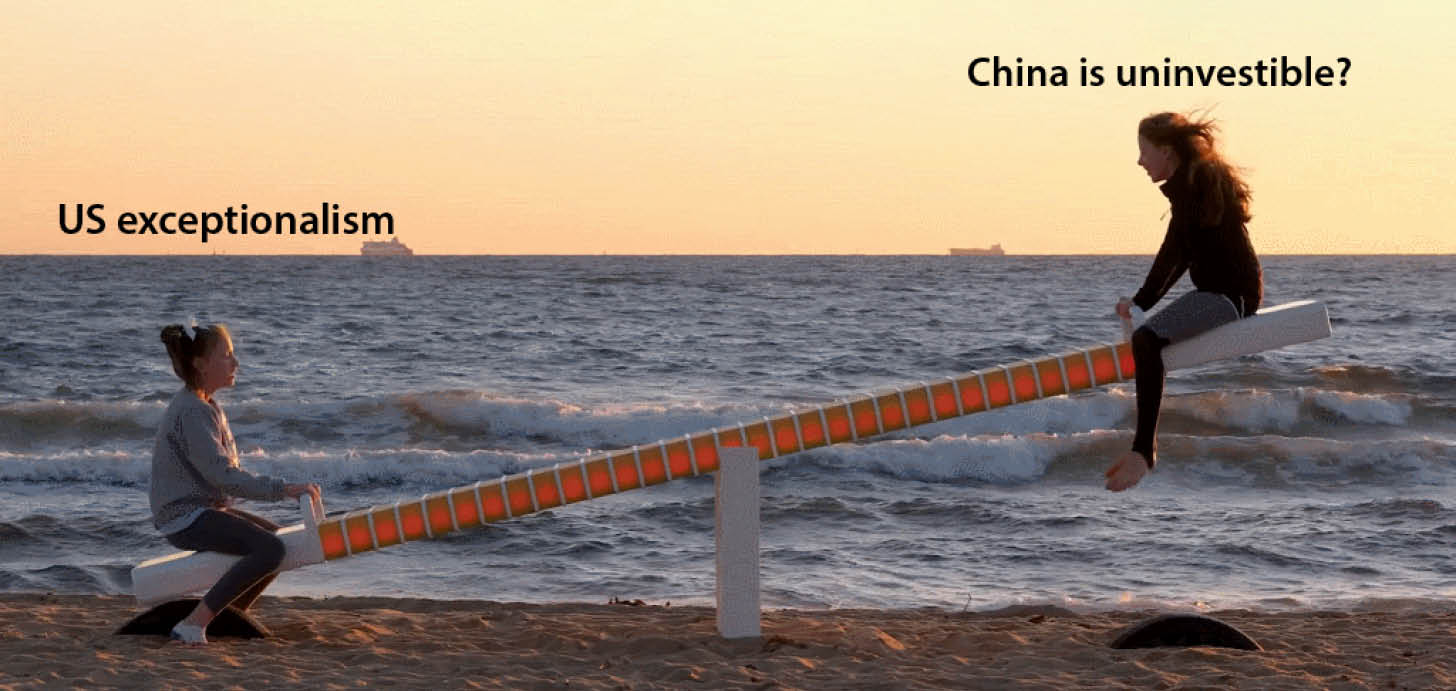

As the decision tree above shows, either path will have massive investment implications for the coming years. Either way, the see-saw that has dominated markets since 2018 is again swinging.

正如上图决策树所示,无论选择哪条路径,都将对今后几年产生巨大的投资影响。无论如何,自 2018 年以来主导市场的拉锯态势再次开始摆动。

Since their January 2024 bottom (see Chinese Policy And Chinese Equities), Chinese stocks have outperformed handsomely. Even so, most investors we talk to want to fade this rally, for a number of reasons that I will attempt address in subsequent papers. In the meantime, there are questions investors have to ponder: Can the US can do industrial policy successfully? Or would the easier path simply be to improve the China relationship?

自 2024 年 1 月触底以来(参见《中国政策与中资股市》),中国股市表现远超预期。尽管如此,我们所接触的大多数投资者仍希望做空这波反弹,原因有多种,我将在后续报告中逐一探讨。在此期间,投资者必须认真思考几个问题:美国真的能成功实施产业政策吗?抑或更简单的做法是改善对华关系?

2) Could the US really do industrial policy?2)美国真能实施产业政策吗?

Economic policy is always a question of choices. Achieving a goal has a cost. And the question that US policymakers, and voters, will now have to confront is whether embracing Chinese-style industrial policies makes sense.

经济政策始终关乎选择。实现目标必然伴随成本。如今,美国决策者和选民必须直面的问题是:采纳中国式的产业政策是否合理?

To be clear, US politicians will most likely argue that it does. Because for politicians, policies that entail more power and more money flowing through politicians’ hands will always sound attractive. And which self-serving politician does not, deep down, believe that he knows better than the market how to allocate capital over the long term? However, the fact that China (and Japan before it) might have been somewhat successful at industrial policy is absolutely no guarantee that the US (or other Western nations) can achieve similarly successful results.

要明确的是,美国政客很可能会辩称确实如此。因为对政客而言,那些能让权力和资金更多流向政客手中的政策,总是听起来更具吸引力。又有哪位自利的政客内心深处不认为自己比市场更懂得如何长期配置资本呢?然而,中国(以及此前的日本)在产业政策方面或许取得过一定成功,这绝不能保证美国(或其他西方国家)也能取得类似的成功。

To some extent, saying that the US needs to do industrial policy because China did industrial policy is choosing to compete with China using Chinese tools. How successful is this really likely to be? The US has many comparative advantages: a strong constitution that guarantees personal freedoms, a private sector with decades of experience at allocating capital, a bankruptcy process that allows assets to be transferred from weak hands to strong hands very quickly, the ability to attract the best and brightest from around the world etc. But industrial policy is not one of them! Nor is attracting the smartest, most ambitious people into government.

在某种程度上,声称美国需要推行产业政策,是因为中国实行了产业政策,这实际上意味着美国选择用中国的工具来与中国竞争。这种做法真的能成功吗?美国拥有诸多比较优势:保障个人自由的强势宪法、数十年积累资本配置经验的私营部门、能够迅速将资产从弱者手中转移到强者手中的破产机制,以及吸引全球顶尖人才的能力等。但产业政策并非其中之一!同样,吸引最聪明、最具雄心的人才进入政府,也不是美国的优势所在。

To stay with the sporting analogies, deciding to follow China down the path of industrial policy is like getting into the ring with Muhammad Ali or George Foreman in their prime. Any sensible person would pick some other sport—tennis, skiing, swimming—in which to challenge these heavyweight fighters, and leave boxing well alone. In short, in its competition with China, would it not make more sense for the US to look to play to its own strengths, instead of to China’s?

继续用体育作比喻,决定追随中国走产业政策的道路,就如同在巅峰时期与穆罕默德·阿里或乔治·福尔曼拳王对决。任何理智的人都会选择其他运动项目——比如网球、滑雪或游泳——来挑战这些重量级拳手,而绝不会去碰拳击。简而言之,在与中国的竞争中,美国难道不应该着眼于发挥自身优势,而非盲目对标中国吗?

One thing that strikes any foreigner visiting America is how the US typically plays its own sports—baseball, American football, basketball—while calling its domestic competitions things like the “World Series”. In other words, the US is the best at winning at its own sports (admittedly, this is better than England, which invents the sports, successfully exports them to the rest of the world, and then fails to win in them ever again!).

任何到访美国的外国人都会注意到,美国人通常只玩自己的体育项目——棒球、美式橄榄球、篮球——却把国内赛事称为“世界系列赛”之类的名称。换句话说,美国在自己擅长的项目上最拿手(诚然,这比英国强得多,因为英国发明了这些运动,成功地将它们推广到全世界,却再也没能在这些项目上赢过)。

So why change now? Why would the US suddenly decide to take on China at its own sport?

那么,为什么现在要改变?为什么美国会突然决定在自己的擅长领域与中国较量呢?

The US has spent the past decade demonizing China and making it out to be a major threat to the US way of life. Now, having achieved its goal, the US is recoiling in horror because, instead of imploding as predicted by the army of China perma-bears, China, through its massive efforts and sacrifices, has essentially taken over every single important industrial supply chain.

过去十年,美国一直不断妖魔化中国,将其描绘成对美国生活方式的重大威胁。如今,目标达成后,美国却惊恐地发现,原本被众多中国空头预言会崩溃的中国,实际上通过巨大的努力和牺牲,已基本掌控了每一项重要的工业供应链。

So where does the US go from here? Arguing that to fight China, the US should be more like China seems somewhat circular. Following China’s roadmap would mean that at best, the US would end up where China is today (would US voters accept that?). More likely, however, the US would end up somewhere much worse, with more corruption, more wasted capital, more inflation and more social strife.

那么,美国接下来该何去何从?主张为了对抗中国,美国应该变得更像中国,这似乎有些逻辑循环。照搬中国的道路,意味着美国最多也只能达到今天中国的水平(美国选民会接受这种结果吗?)。更可能的情况是,美国最终会陷入更糟糕的局面——腐败更多、资本浪费更严重、通货膨胀更高、社会矛盾更激烈。

To illustrate what I mean, consider California’s high-speed train compared with the roll-out of China’s high-speed rail system. Having spent US$15bn since 2008 and having laid just 110 km of track, it now seems that the US is figuring out that building railways without Chinese workers is actually really hard.

为了说明我的观点,不妨比较一下加州高铁项目与中国高铁系统的推广。自 2008 年以来,美国已投入 150 亿美元,却仅铺设了 110 公里的轨道,如今看来,美国似乎终于意识到:在没有中国工人的情况下建设铁路实际上非常困难。

More importantly, and at the risk of flogging a dead horse, it must be noted that China’s push to de-Westernize its supply chains came at great cost to the Chinese economy and Chinese society, and entailed a serious anti-corruption drive that saw dozens of Chinese politicians arrested, tried and sentenced to hard labor. Would US policymakers countenance such judicial repression? And if not, how does one prevent free-for-all feeding at the public trough?

更重要的是,尽管有重复之嫌,仍需指出,中国推动供应链去西方化,对中国经济和社会造成了巨大代价,并伴随着一场严厉的反腐败运动,数十名中国政界人士被逮捕、审判并判处劳役。美国政策制定者会容忍这种司法压制吗?如果不会,又该如何防止公共利益被肆意瓜分?

In short, looking at the prospect of US industrial policy raises more questions than it answers, including:

简而言之,审视美国工业政策的前景所引发的问题远多于解答,包括:

- Does the US have the institutional make-up to follow through on industrial policy? After all, the US does not have a Ministry of Industry and Information Technology, nor a Ministry of Science and Technology.

美国是否具备实施工业政策的制度架构?毕竟,美国没有工业和信息化部,也没有科技部。 - Can the US afford to de-Sinify its supply chains? Or are US policymakers simply virtue-signaling around the subject?

美国能否负担得起其供应链去中国化?抑或美国政策制定者只是在该议题上进行道德表态? - Is the demonization of China and the need to de-Sinify supply chains just one big excuse for a power and money grab of epic proportions? If it is, how will US policymakers deal with the consequent corruption?

- If US policymakers really are serious about de-Sinifying supply chains, will America’s elites accept the redeployment of capital into activities with lower returns on invested capital, and that in consequence the stock market will struggle and the US dollar roll over?

如果美国政策制定者真的决心实现供应链去中国化,美国精英阶层是否愿意接受资本重新配置到回报率较低的领域?这将导致股市表现疲软,美元走弱

The answer to the last question seems most obvious: no! With US equity market capitalization now more than twice the value of US GDP, it could be argued that maintaining stable equity prices is now essential to keeping US economic growth on track (see Concerning Signals On US Growth). All of which brings us to the other option: mending fences with China.

最后一个疑问的答案似乎再明显不过:不行!如今美国股市市值已超过美国 GDP 的两倍,因此维持股市价格稳定,对确保美国经济增长持续在正确轨道上运行变得至关重要(参见《关于美国增长的警示信号》)。所有这些都引出了另一个选项:修复与中国的关系。

3) Can the US mend fences with China?

We live in a world in which:

- China cannot buy what it wants from the US, either because the US will not allow the sales (high-end semiconductors), or because the US struggles to produce the goods (Boeing planes).

中国也无法从美国购买它想要的东西,要么是因为美国不允许销售(高端半导体),要么是因为美国自身难以生产这些产品(波音飞机)。 - The US can no longer buy what it really wants from China (rare earths, magnets).

美国也买不到它真正需要的东西(稀土、磁铁)。 - The US won’t allow China to sell what China really wants to sell in the US (higher value added goods such as cars, telecom switches, tractors, earth moving equipment, trains, nuclear power plants), even if US consumers would actually love these goods, and even need them. For example, can US farmers remain globally competitive if everyone else drives cheap tractors and they do not?

即便美国消费者真心喜爱甚至需要这些商品,美国仍不允许中国向美国出售中国真正想卖的商品(如汽车、电信交换机、拖拉机、土方设备、火车、核电站等高附加值产品)。例如,如果其他国家都使用廉价拖拉机,而美国农民却无法使用,他们还能在全球保持竞争力吗? - What the US really wants to sell to China (soybeans, liquefied natural gas), China can generally get elsewhere (Russia, Brazil, Colombia) for less money and with greater reliability.

Surely, this does not look like an optimal system. And if only the US and China could get along better, the prospects for trade linked productivity gains would soar. On this point, in a recent interview US Treasury Secretary Scott Bessent highlighted that Trump and Xi could meet as many as four times over the coming year. This is more than the presidents of China and the US have ever met over such a short period; a frequency of interactions that opens the doors to a possible dramatic improvement in the bilateral relationship. At least, this is what Bessent hinted at. And in fairness, Trump does seem to be going out of his way to repair a badly frayed relationship.

To begin with, Trump’s comments about living in a G2 world must have been music to Xi’s ears. One of Xi’s main foreign policy goals is for China to be considered a great power and to deal with the US on an equal footing. Trump essentially granted this at the Busan summit in Korea.

Following the Busan summit, the Rand Corporation (essentially the outsourced think tank of the Pentagon) published a report which argued that instead of viewing China as an adversary, it would be in the longer term US interest to build a more constructive relationship with China. The report even went as far as highlighting that the US really has no important national interests in Taiwan to defend. Interestingly, the report was pulled after a couple of weeks. But the fact that it was even written, let alone published, seems to indicate a change in attitudes among at least some of the members of the US military-industrial complex?

釜山峰会之后,兰德公司(基本上是五角大楼的外包智库)发布了一份报告,主张与其将中国视为对手,不如从长远来看,美国应致力于与中国的建设性关系。该报告甚至指出,美国在台湾并无需要捍卫的重要国家利益。有趣的是,这份报告在发布几周后便被撤下。但报告不仅被撰写出来,还得以发表的事实,似乎表明至少美国军火工业复合体中的一些人态度正在发生变化?

And then, of course, there is the latest US National Security Strategy, recently published by the White House. This highlighted:

当然,还有最近由白宫发布的最新美国国家安全战略。该文件强调了:

- That the US is very keen on shifting its diplomatic and military focus back to the Western hemisphere (see Fort Monroe And LatAm Assets and The ‘Fort Monroe’ Doctrine In Practice). Of course, this might be seen as a way to push China out of the hemisphere. But the truth is that China does not really have much in the way of core national interests in the region anyway. So an increased US focus towards Latin America need not generate massive tensions with China.

美国非常热衷于将其外交与军事重心重新转向西半球(参见《弗吉尼亚要塞与拉美资产》及《“弗吉尼亚要塞”原则的实践》)。当然,这可能被视作将中国排挤出该地区的手段。但事实是,中国在该地区实际上并无重大核心国家利益。因此,美国对拉丁美洲关注度的提升,并不必然引发与中国的巨大紧张关系。 - That the administration has little time for America’s European allies. In fact, the administration seems quite keen on dumping the whole Ukraine mess on Europe’s doorstep. This is an important message that will raise questions across Asia about how dependable the US really is as a friend. If the US is willing to kick France or Germany when they are down, why would South Korean, Taiwanese or Japanese policymakers imagine that they will enjoy more favorable treatment in times of stress?

该政府对美国的欧洲盟友缺乏重视。事实上,该政府似乎急于将整个乌克兰危机问题推给欧洲。这一重要信号将在亚洲引发广泛疑问:美国作为盟友究竟有多可靠?如果美国愿意在法国或德国陷入困境时落井下石,那么韩国、台湾或日本的政策制定者又怎能指望在危机时刻获得更优待的对待? - A clear desire to move away from an ideologically driven foreign policy towards a more pragmatic approach:

明确希望摆脱意识形态驱动的外交政策,转而采取更为务实的方针:

- And finally, more of a commitment to avoid foreign entanglements:

最后,更倾向于避免卷入海外纷争:

- Against this, it is tempting to quote Woodrow Wilson who, on his election in 1912 declared that “it would be the irony of fate if my administration had to deal mostly with foreign affairs.” In other words, events have a way of making fools of anyone forecasting the future. Trump may announce more isolationist goals. But events may conspire against his wishes.

与此相对,人们很容易引用伍德罗·威尔逊的话,他在 1912 年当选总统时曾表示:“如果我的政府主要需要处理外交事务,那将是命运的讽刺。”换句话说,事件总爱让那些预测未来的人出丑。特朗普可能会宣布更多孤立主义的目标,但事态的发展或许会违背他的意愿。

Still, if China is no longer the enemy it was thought to be just a few months ago—and the National Security Strategy does make it look as if China has been downgraded from “existential threat” to “strategic competitor,” then does China still remain “uninvestible”? Especially if it continues to outperform?

然而,如果中国已不再像几个月前人们所认为的那样是敌人——而《国家安全战略》确实似乎表明,中国已从“生存性威胁”降级为“战略竞争对手”,那么中国是否仍应被视为“不可投资”?尤其是当它持续表现优异之时?